Goldiam International Ltd. (NSE: GOLDIAM) is a prominent player in India’s gems and jewelry sector, specializing in the manufacturing and export of diamond-studded gold, silver, and platinum jewelry. Established in 1986 and headquartered in Mumbai, the company has carved a niche in both natural and lab-grown diamond segments, with a significant export footprint, particularly in the United States and Europe.

Financial Performance

- Revenue Growth: In Q3 FY25, Goldiam reported consolidated revenue of ₹287.96 crore, marking a 38.55% year-on-year increase.

- Net Profit: The net profit for the same quarter stood at ₹49.73 crore, reflecting a substantial 53.52% growth compared to the previous year.

- Annual Performance: For the trailing twelve months, the company achieved a net income of ₹1.12 billion, with earnings per share (EPS) of ₹10.38 and a price-to-earnings (P/E) ratio of 29.41.

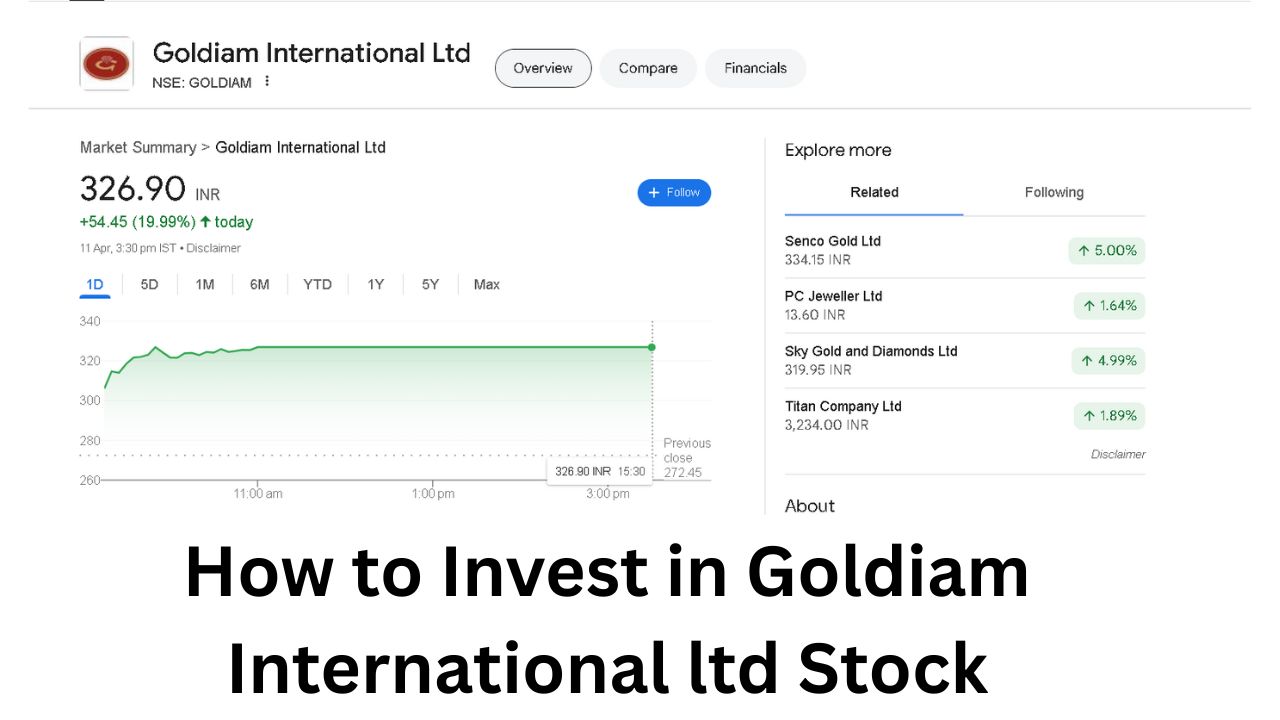

Stock Performance

- Current Price: As of April 4, 2025, the stock was trading at ₹307.45.

- 52-Week Range: The stock has experienced significant volatility, with a 52-week range between ₹143.55 and ₹569.00.

- Recent Trends: Despite strong financials, the stock witnessed a sharp decline of 16.54% on April 4, 2025, closing at ₹307.45.

Strategic Initiatives

- Expansion Plans: Goldiam is evaluating the feasibility of establishing a manufacturing facility in the USA to bolster its market presence.

- Retail Growth: The company has expanded its retail footprint by inaugurating its third store for lab-grown diamond jewelry in Mumbai under the brand name “ORIGEM.”

Investment Considerations

- Debt-Free Status: Goldiam maintains a debt-free balance sheet, enhancing its financial stability.

- Promoter Holding: The promoter holding stands at 62.38%, with no shares pledged, indicating strong promoter confidence.

- Technical Indicators: Technical analysis suggests a ‘sell’ signal in the short term, while the one-month outlook indicates a ‘buy’ signal, reflecting mixed market sentiments.

Conclusion

Goldiam International Ltd. presents a compelling investment opportunity, backed by robust financial performance, strategic expansion plans, and a strong market position in the gems and jewelry sector. However, potential investors should consider the recent stock volatility and conduct thorough due diligence before making investment decisions.